Deep Market Intelligence with Research Swarm on Questflow

From a single question to actionable investment insights—in minutes, for cents, with agent-powered research

Last week, we showed you how to create a Swarm from scratch in Questflow.

This time, we’re going deeper—showing you how to use an existing Swarm to generate high-value insights in minutes.

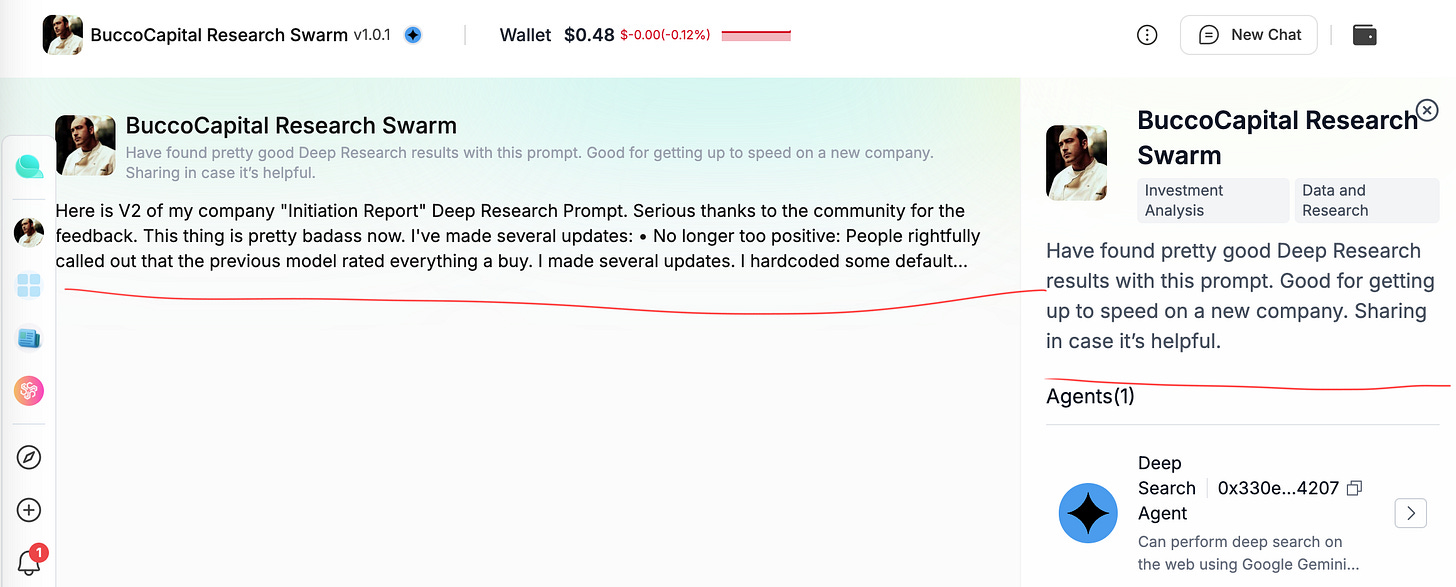

To make it real, we’ll walk through BuccoCapital Research Swarm, created by the well-known tech and investment commentator BuccoCapital. This Swarm is designed for deep equity research—perfect for quickly understanding companies, markets, and investment opportunities.

And because Questflow now supports Agent Wallet micro-payments, you can run these analyses for just a few cents per query. No subscriptions, no monthly top-ups—just pay for what you use.

Step 1 – Discovering the Swarm

Inside Questflow’s Agent Directory, search for BuccoCapital Research Swarm.

The Swarm description tells you what to expect: it’s built on the creator’s “Initiation Report” Deep Research Prompt (now on V2), fine-tuned with community feedback to be more objective and customizable.

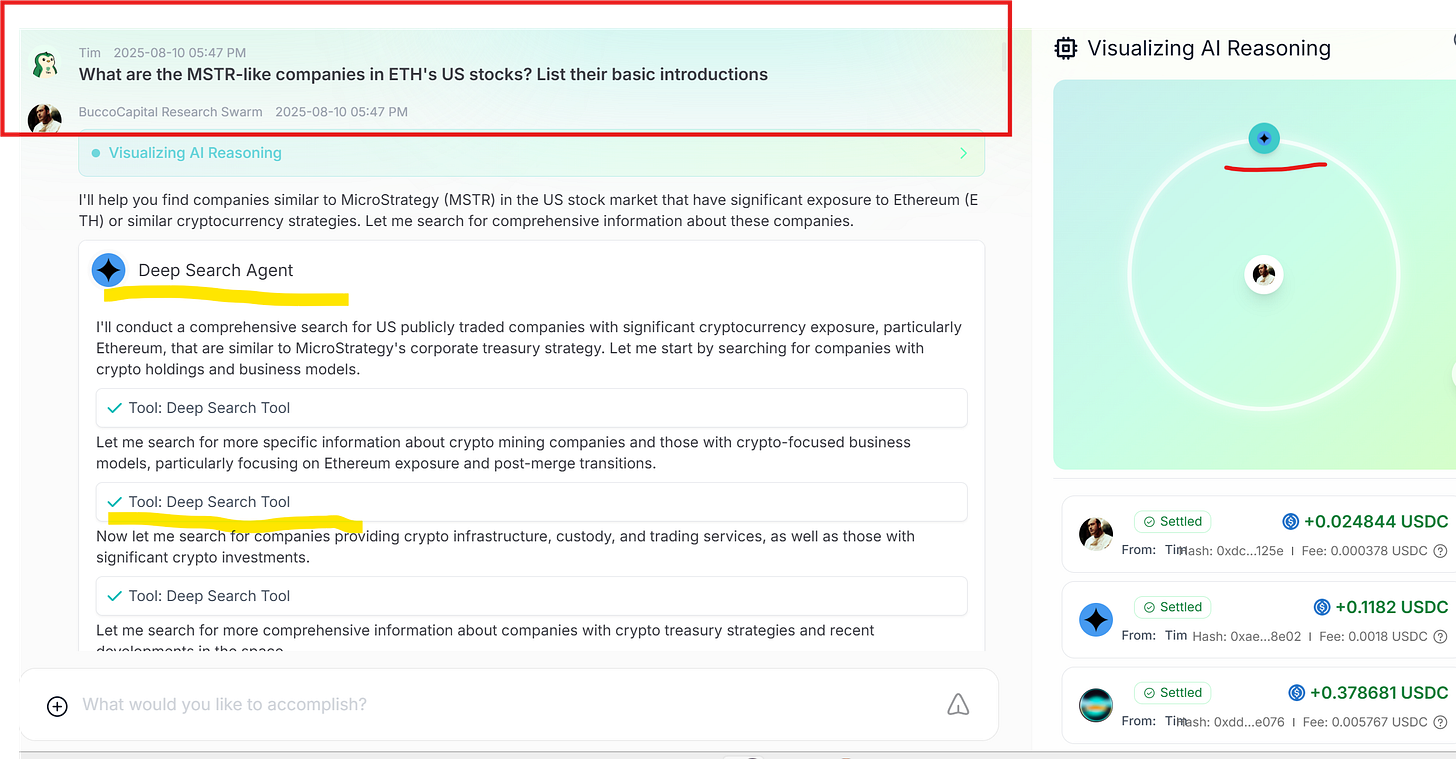

Step 2 – Starting with a Broad Question

To see it in action, we start with a wide-angle query:

“What are the MSTR-like companies in ETH's US stocks? List their basic introductions.”

In seconds, the Swarm—powered by the Deep Search Agent—returns a detailed list of public companies with significant ETH or broader crypto exposure.

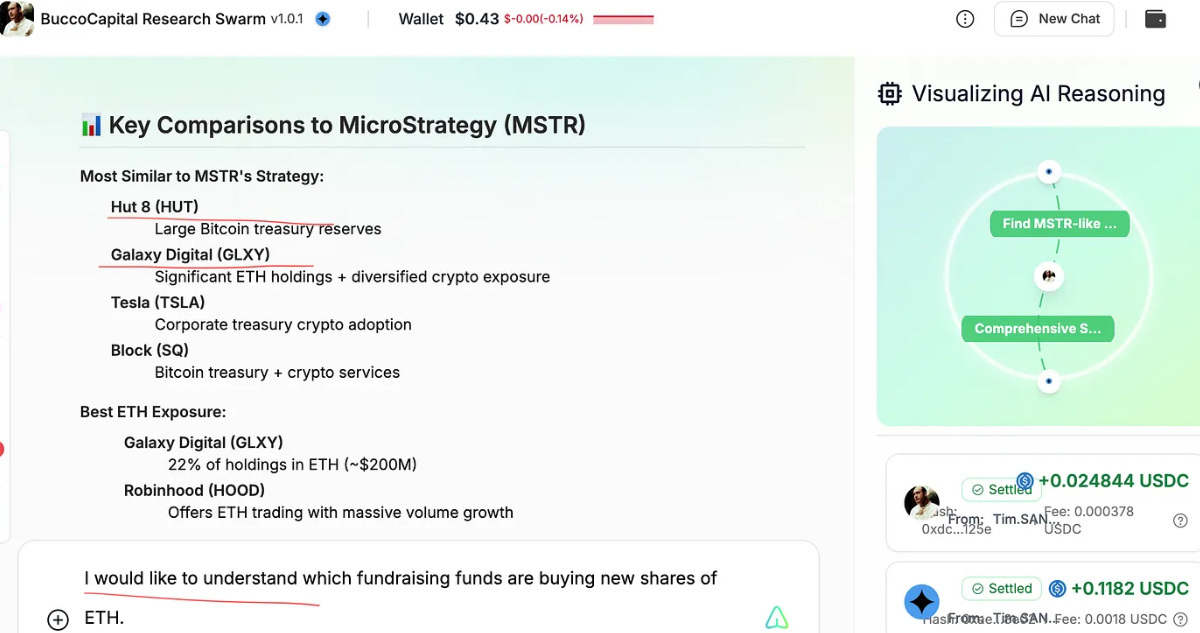

Step 3 – Reviewing First Results

The output gives an at-a-glance comparison of companies like Hut 8, Galaxy Digital, Tesla, and Block—including treasury strategies, ETH holdings, and crypto adoption patterns.

At this point, you have a high-level landscape. But research is iterative—let’s dig deeper.

Step 4 – Drilling Down into Specifics

Next, we ask:

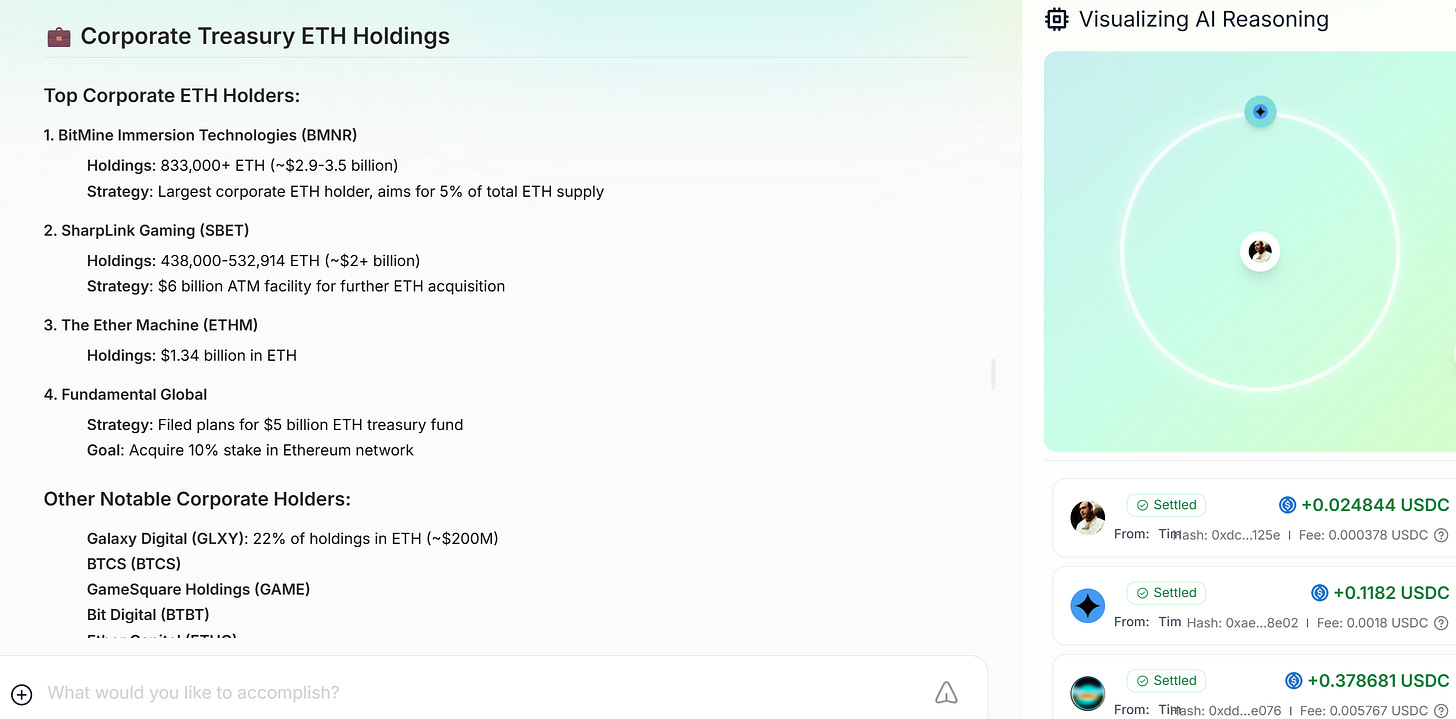

“I would like to understand which fundraising funds are buying new shares of ETH.”

The Swarm returns top corporate ETH holders, with details on strategies, holdings, and acquisition plans—covering big names like BitMine Immersion Technologies, SharpLink Gaming, and The Ether Machine.

Step 5 – Refining the Target List

Now that we know the key players, it’s time to focus. We ask:

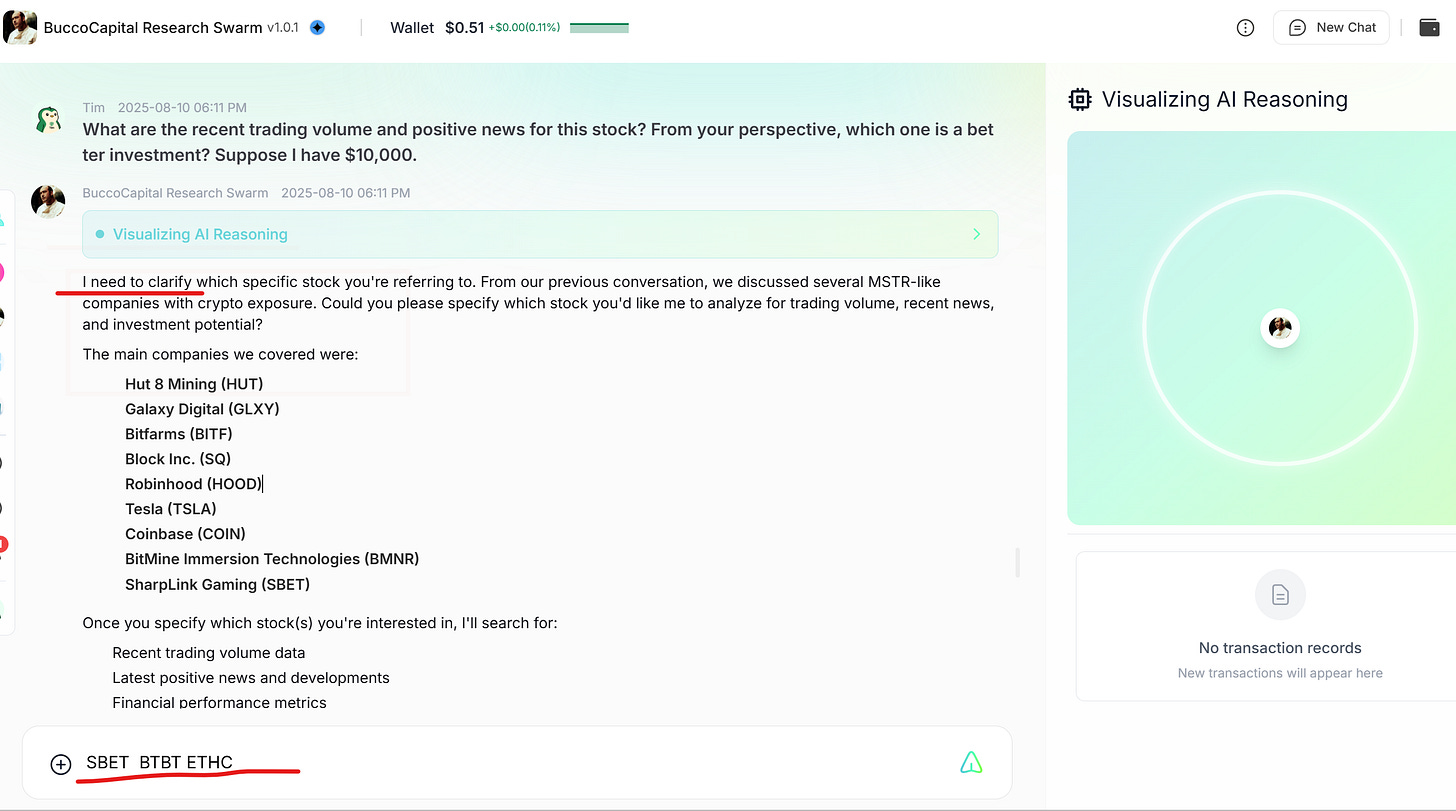

“What are the recent trading volume and positive news for this stock? From your perspective, which one is a better investment? Suppose I have $10,000.”

The Swarm requests clarification—so we specify: SBET, BTBT, ETHC.

Step 6 – Deep Analysis & Final Recommendation

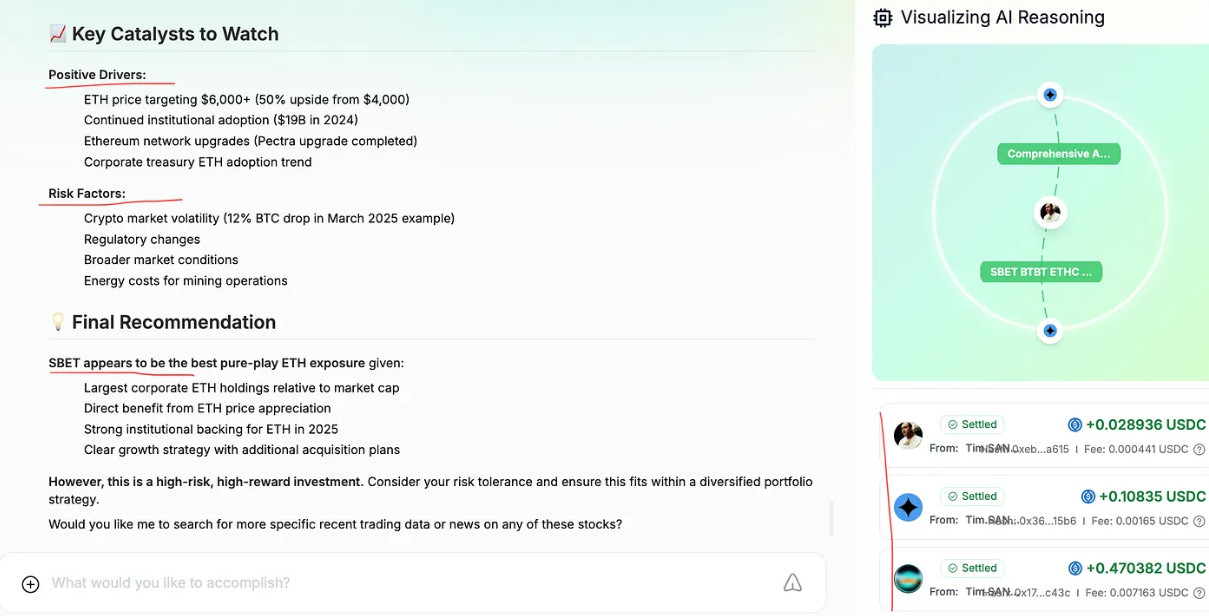

With the refined list, the Swarm runs a comprehensive catalyst and risk analysis, covering ETH price targets, institutional adoption trends, and regulatory factors.

The verdict? SBET offers the strongest pure-play ETH exposure—though the Swarm flags it as a high-risk, high-reward bet.

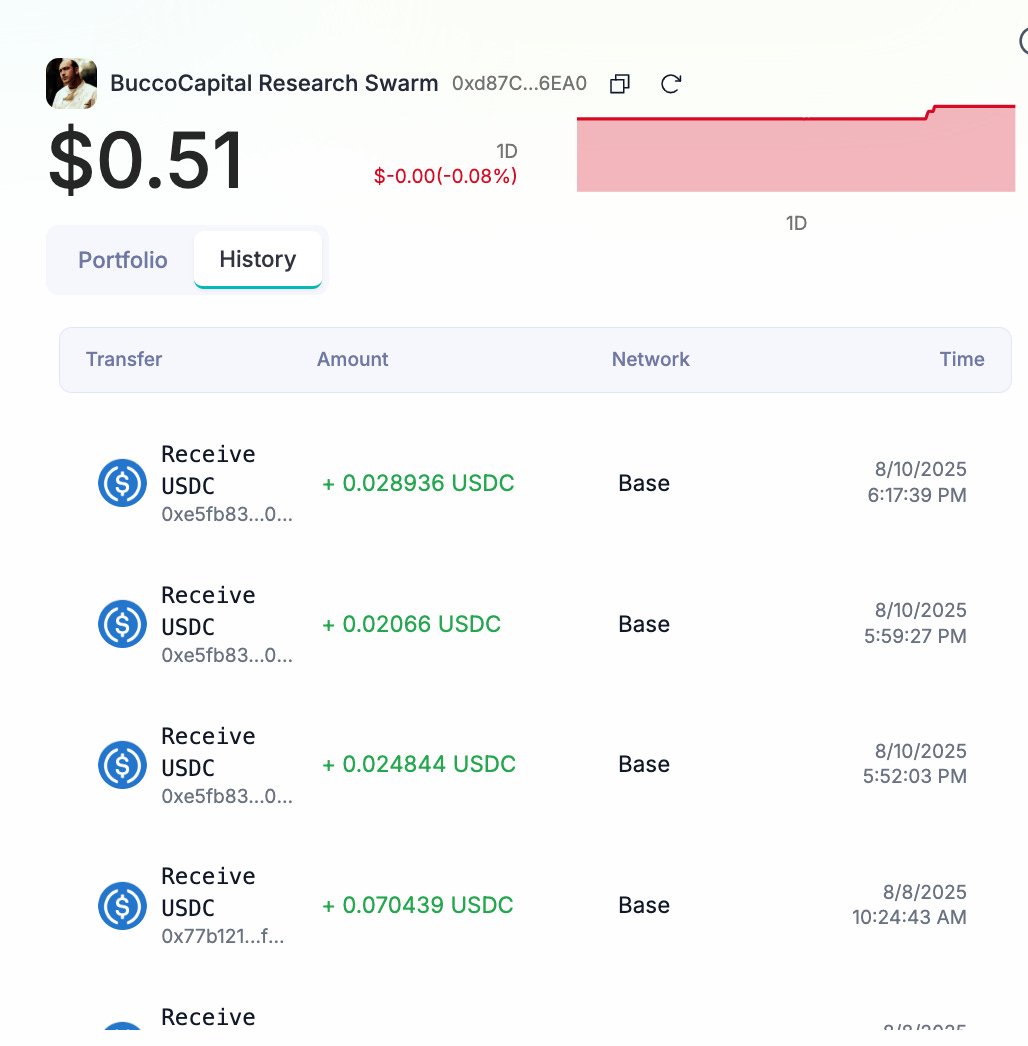

Step 7 – Pay-per-Use Transparency

One unique benefit of Questflow is the on-chain Agent Wallet. Throughout this session, each step triggered a small micro-payment—clearly shown in USDC with associated transaction hashes.

This model means you only pay for what you actually use—perfect for casual investors, deep researchers, and data-driven teams alike.

Why This Matters

With BuccoCapital Research Swarm, you can go from a broad market question to a fully reasoned investment recommendation in under 10 minutes—and for under $1.

By combining:

Multi-agent orchestration (MAOP protocol)

Pay-per-task microtransactions

Composable AI workflows

Questflow makes advanced research accessible, affordable, and transparent.

Try It Yourself

Whether you’re evaluating crypto-exposed stocks, scouting new sectors, or validating investment theses, you can replicate this exact process with any Swarm in Questflow’s directory.

Your insights are just a prompt away—and now, so is your next alpha.